Federal Reserve Chairman Ben Bernanke's "solution" to the country's economic woes, a new, even larger asset bubble, is becoming evident in several sectors of the economy, from equities to real estate. The following charts suggest that the bubble the Fed is inflating in the housing market will eclipse the last one, which was big enough to plunge the country into an economic depression when it burst.

First, the year-over-year increase in home prices since 2008 has been steeper than the YoY during the last housing bubble:

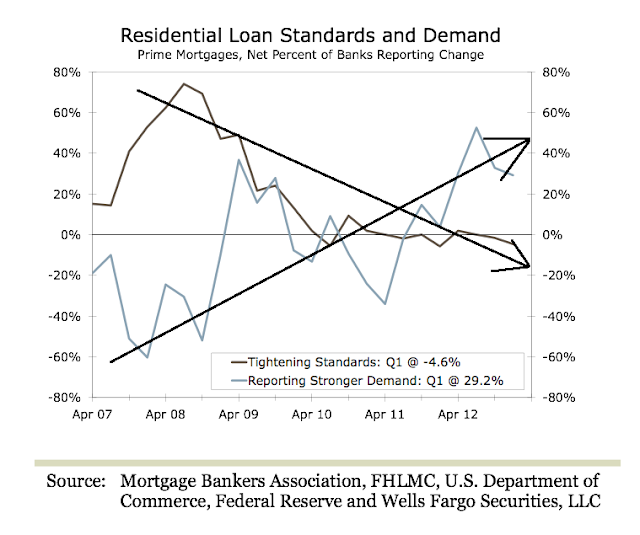

Second, the inversely proportional decrease in mortgage standards and increase in demand for mortgages has been starker than it was during the last bubble:

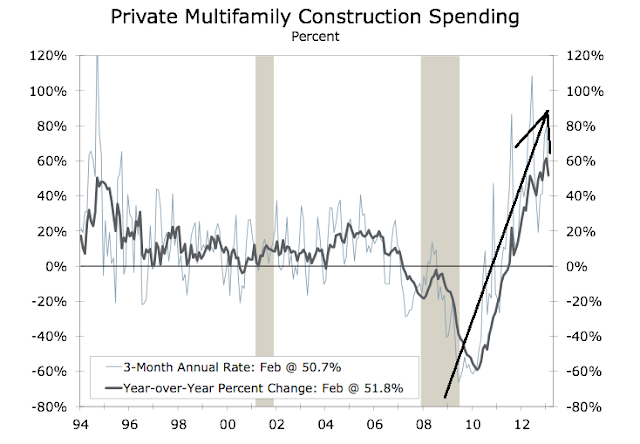

Third, apartment and condo starts have been skyrocketing at a rate far eclipsing that of the last bubble:

Fourth, investors are throwing cheap, Fed-provided money at housing at a rate far exceeding that of the last bubble:

0 comments:

Post a Comment

Note: Only a member of this blog may post a comment.